Measuring Black Friday / Cyber Monday Effectiveness

Calculating amidst the chaos.

Four Things First

Don't read that, read this 👇

1. "Do Americans really brawl on Black Friday?"

Yes.

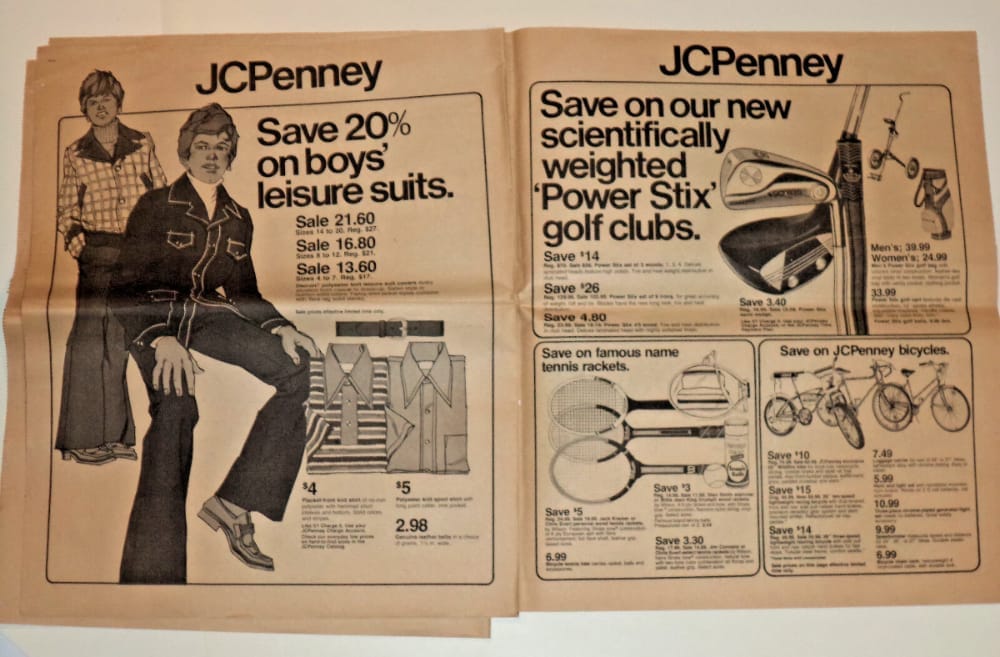

2. Black Friday Ads from Yesteryear ⛓️

"In my day you'd get jorts & a 72dpi modem for $1.99!"

3. Black Friday Pricing Meme

Would love to see any real-life examples of this happening...

4. Black Friday's Impact on the Environment

Deliveries, returns, plastic packaging, and more...

The Long Form 📓

A few paragraphs on BFCM measurement challenges and the vendors who are providing solutions. Interested in a vendor? Head to their Blurbs page and contact them anonymously.

From doorbusters to digital complexity

I remember my neighbor used to wake up at 4am and drive to the mall just to snag what they called a doorbuster. JC Penney tracked those sales back then by coupon redemption or how fast advertised items vanished from shelves. Fast forward to today and the landscape is wildly different. There are over 92,000 different places people can buy socks as gifts, all advertised across sprawling digital ecosystems. Suddenly, measuring effectiveness isn’t about counting coupons, but untangling a web of data from countless channels.

Black Friday measurement demands evolution

Digital advertising now spans search, social, CTV, email and even direct mail — driving results that defy simple attribution. The old tricks of last-click or single-touch models don’t cut it anymore, especially during high-stakes Black Friday weekends. Marketers need measurement that sees the whole picture: which channels truly move the needle, which amplify each other, and where dollars are wasted. Without this, budgets are gambles instead of calculated plays.

Understanding true channel contributions matters

Imagine spending $100,000 for Black Friday marketing split like this: $30,000 on paid social, $20,000 on paid search, $10,000 on email marketing, $40,000 on TV ads. Post-holiday sales hit $400,000. At first glance, TV looks like the heavy hitter due to sheer spend, but what really drove sales? Was that giant TV buy efficient, or did smaller, more targeted channels like email punch above their weight? If you’re guessing, you’re leaving money on the table.

Marketing Mix Modeling reveals hidden impact

Advanced Marketing Mix Modeling (MMM) steps in here, using sophisticated stats to assign sales credit across every channel, not just the last touchpoint. It uncovers patterns and synergy effects that simple attribution tools miss. MMM quantifies which slices of your media mix correlate with real incremental sales and which are just noise. It transforms raw historical data into actionable intelligence for smarter budget allocation.

Incrementality testing adds scientific precision

Incrementality tests take MMM further by scientifically verifying cause and effect through A/B or holdout experiments. This is critical during Black Friday’s ROI crunch where guesswork can cost six figures. By isolating test markets or audiences, you get causal evidence on whether an ad spend genuinely delivers new revenue or just shifts sales from one channel or period to another. This eliminates bias and confirms which tactics to scale or cut.

Just in case you forgot what this looked like.

Privacy and first-party data drive accuracy

With privacy regs tightening and ad ecosystems fragmenting, relying on third-party cookies or pixels alone risks missing 40% or more of conversions. The smartest attribution partners now integrate first-party data and server-side tracking for 100% capture of conversion events. This creates a holistic view of consumer journeys across web, retail, marketplaces, and CTV without compromising compliance. The resulting data fidelity is key to confident Black Friday spending.

Real-time insights fuel agile campaign shifts

Black Friday doesn’t wait weeks for reports; it requires real-time or near real-time data. Leading platforms combine rapid data ingestion from hundreds of ad integrations, automated incrementality testing, and weekly-updated MMM models. These tools empower marketers to pivot budgets mid-campaign—to double down on high ROAS tactics or dial back on laggards quickly. The competitive edge goes to teams that see the truth and act on it fast.

Synergies mean the whole is greater than parts

Measurement uncovers that channels often work best in tandem. For example, TV ads may boost paid search effectiveness by raising brand awareness, while social campaigns may drive incremental sales only when paired with targeted email follow-ups. MMM and incrementality testing expose these cross-channel halo effects, guiding budget toward allocations that maximize total business impact rather than siloed channel wins.

Why Black Friday demands the right partner now

Black Friday media budgets are often six or seven figures, and any inefficiency compounds at scale. Partnering with an attribution and MMM vendor capable of deep, custom modeling, first-party data integration, and rapid reporting is more than wise—it’s essential. These vendors help turn sprawling multi-channel chaos into a strategic advantage, delivering clear answers when every ad dollar counts and complexity peaks.

Data Speaks and Haus lead with actionable rigor

Data Speaks stands out by harnessing AI-driven analytics and integrating first-party data across 300+ sources to build bespoke models. Their approach captures true incrementality and media mix effects with minimal noise, ensuring marketers see beyond flawed pixel data to total conversion impact. On the other hand, Haus uses privacy-first geo-based incrementality testing, automating experiments that reveal causal ad impact across omnichannel mixes without cookie dependence. These leaders optimize Black Friday media precision where it matters most.

Broad capabilities span live purchase to cross-channel insights

Vendors like Attain complement attribution with real-time purchase data from millions of consumers, adding unmatched transparency into offline and online sales lift. Platforms such as Rockerbox and Northbeam unify multi-touch attribution and MMM across 100+ channels for comprehensive media performance analytics. Meanwhile, Measured and Prescient optimize budgets dynamically using daily-refreshing MMM models and incrementality tests focused on media spend efficiency.

Choosing vendors for holiday campaign mastery

Smart digital marketers tasked with sorting through vendors should prioritize those offering strong incrementality measurement, seamless first-party data integration, and automated multi-channel MMM models. Alongside Data Speaks and Haus, companies like Bonsai, Lifesight, Keen, INCRMNTAL, and Leavened provide robust solutions that balance AI, privacy, and media science. These partners ensure media dollars on Black Friday are vested in strategies that actually drive lift, not just clicks or impressions.

Summary of key takeaways for Black Friday

- Traditional Black Friday measurement is obsolete in today’s fragmented omnichannel world.

- Advanced MMM combined with incrementality testing provides granular, causal insights critical for optimizing holiday spend.

- First-party data integration and privacy-compliant tracking unlock full conversion visibility, reducing gaps.

- Real-time or near-real-time reporting enables agile budget shifts amid rapid consumer behavior changes.

- Channel synergies are common - cross-channel effects should guide budget allocation over siloed spend analysis.

- Partner with vendors that automate experiments, leverage AI, and handle complex data with transparency.

- Invest in solutions that incorporate offline and online purchase data for a complete sales impact picture.

- Brands that apply ongoing, modeled learnings each Black Friday build a sustainable competitive advantage.

Strategic vendor characteristics to seek

- Expertise in Incrementality and Media Mix Modeling (MMM) at scale.

- Integration of privacy-first first-party data and server-side conversion capture.

- Automated experiment setup with fast insight turnaround.

- Ability to handle complex channel combos: search, social, CTV, email, direct mail, retail.

- AI-enhanced predictive analytics for forecasting and budget planning.

- Transparency in methodology and model validation.

- Strong cross-platform ad integrations spanning digital and offline touchpoints.

- Flexible pricing models aligned with ad spend and business scale.